There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Interested in getting a core finance job? 📗

Get a career in Investment banking?💰

Why not enroll for the compact 6 IN 1 course on Fundamental analysis, scientific analysis, financial modeling & valuation and Value investing combined with excel⭐💯

Why is it so important?🤔

You would learn to analyze the annual report of the company in detail📝. Learn unlimited financial ratios for all industries like BFSI, Pharma, new age tech business and so on.📖.

Learn to prepare the financial model of the company, undertake valuation and assist your client in making the right choice.🧾.

Why forget the Value investing strategies to invest in the market as suggested by Mr Warren Buffett.?

That's it?. No

How to forget hands on application on excel, placement training and assistance⭐.

Let us begin the journey to the highest paid jobs in the world with our experts!

Learn live with top educators, chat with teachers and other attendees, and get your doubts cleared.

Our curriculum is designed by experts to make sure you get the best learning experience.

Interact and network with like-minded folks from various backgrounds in exclusive chat groups.

Stuck on something? Discuss it with your peers and the instructors in the inbuilt chat groups.

With the quizzes and live tests practice what you learned, and track your class performance.

Flaunt your skills with course certificates. You can showcase the certificates on LinkedIn with a click.

Over 20K+ students have already started their career into investment banking.

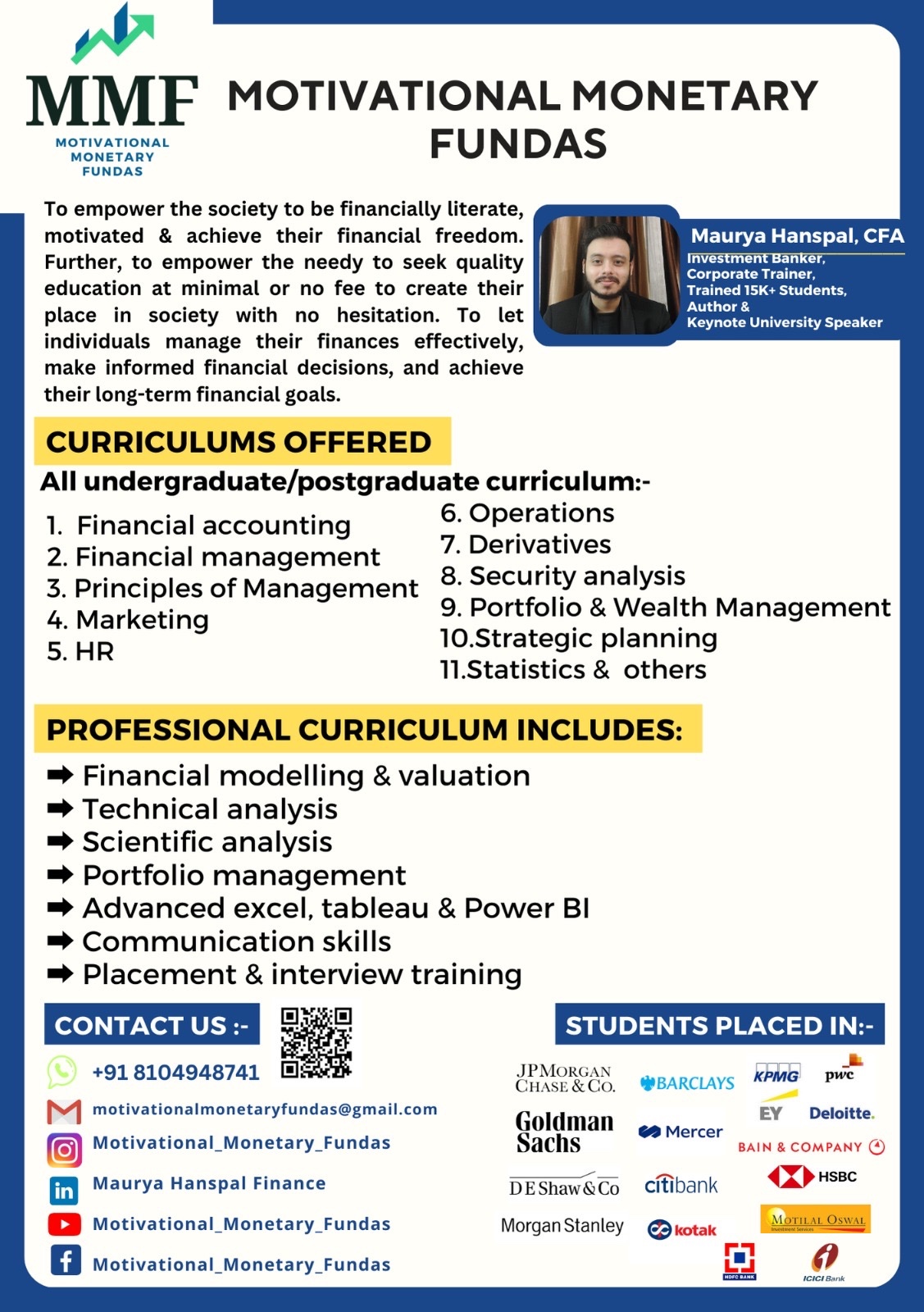

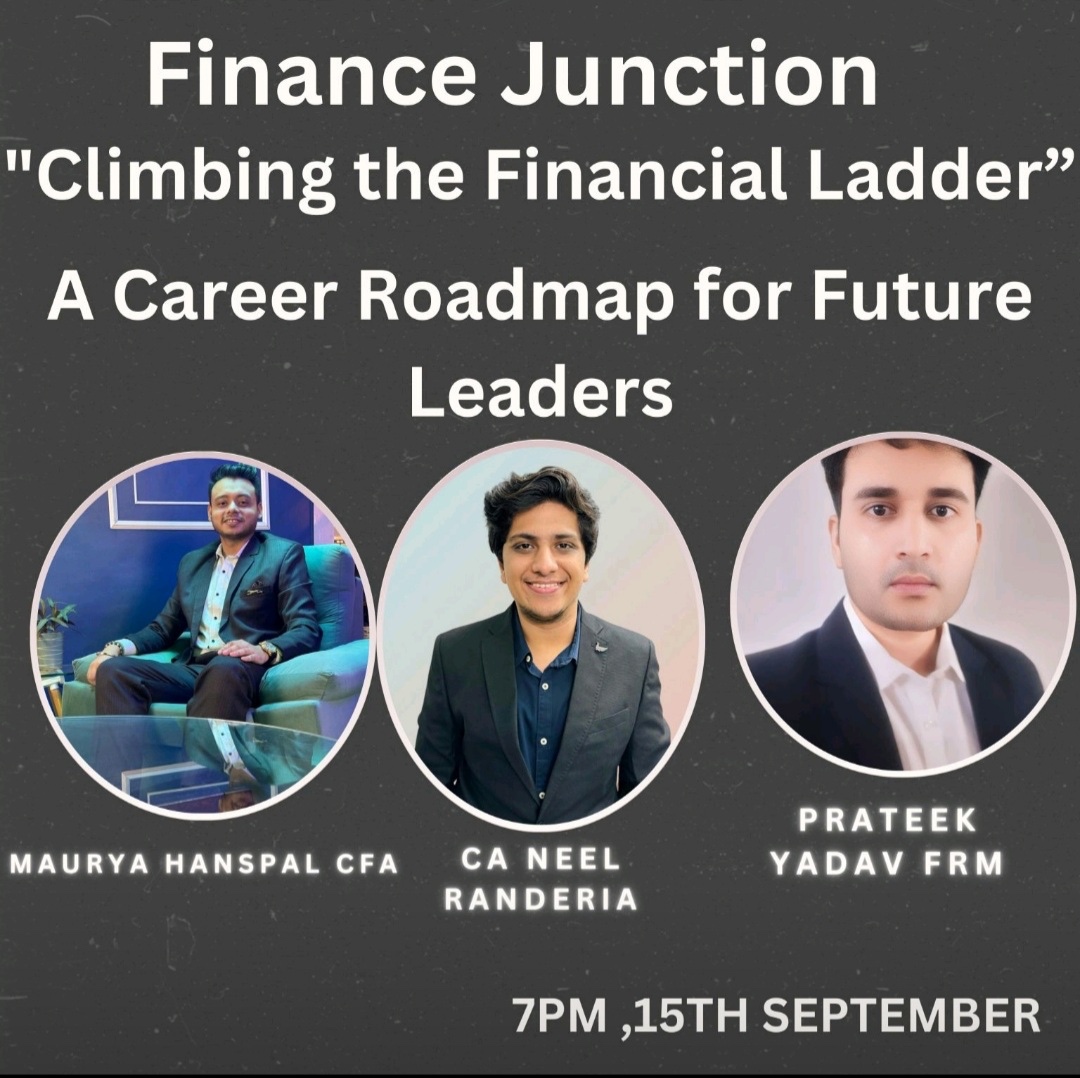

Here are our awesome team.

Founder & CEO

Head Trainer for financial modelling & valuation, Portfolio management

Head Trainer for financial accounting, management & cost accounting

Head Trainer for Derivatives, option trading & Statistics

Senior trainer for corporate Finance

Dimpesh Taank: Happy to get placed at UBS Advisory. The curriculum is a deep dive that covers the practical aspects of valuation taught nowhere.

Ramneek Kaur, Seems great to get an opportunity at KPMG Financial modelling & valuation. The practical scenario based financial models are something which only MMF offers makes you feel much more empowered.

Sadia Alam, I am proud to call myself as an Oracle consultant. Maurya's deep dive sessions into financial modelling for BFSI space is something which is taught nowhere. Sector specific valuation trainings helps student choose their sector and value the same.

Harshitha Uppala, The detailed portfolio management sessions helped me secure a role at JP Morgan & then further at HSBC advisory. His portfolio management and scientific analysis sessions helped to clear all my interviews.

Jahanvi Chhabra

The market reconciliation role at American Express is something I got due to the global market training at MMF. The global markets sessions are something which only MMF offers in the industry. Further, the advanced excel sessions are worth attending that get updated on continuous basis.

Gaganpreet Kaur

My interview was exactly similar to what I was trained for during the mock interviews. at ANZ. I went through more than 20+ mocks and got a great understanding about equity research profiles.

Sukanya, My profile at HDFC as investment specialist is attributes to MMF. Maurya used to spend endless hours with his team in trying to create financial modelling live projects for me. He made me create more than 10+ financial models and directly helped in my placement at HDFC.

Prattyush Roy, my interest in finance lies just because of Maurya Hanspal. He cleared all my queries and concepts in a way which even faculties could not. I personally recommend him to join a university and make the lives of students easier.

Raj Pakhare, Derivatives trading role at Morgan Stanley is a dream come true. The investment banking curriculum along with Derivatives provided me an in depth analysis of how trading is done in real life.

Sitanshu Patel, Equity research at JP Morgan is dream profile for me for which I was assisted by MMF. The long hours trainings, though tiring but were super productive. The endless doubt sessions help me in conceptual clarity.

Somya Dengre, Credit underwriter at Goldman Sachs is something which MMF helped me to prepare. Their holistic program covers all major areas on investment banking and makes you suitable for multiple profiles.

Mahi Gautam, The curriculum is something which I personally recommend to everyone in the industry. The practical concepts covered here literally changes your perspective about the world of finance and helps you climb the ladder.

Learning all about fundamental analysis, financial modelling & valuation.

Going ahead in portfolio management & scientific analysis.

Live project allotment.

Placement training and assistance to dedicated students.

HAPPY CLIENTS

COMPLETED PROJECTS

COUNTRIES SERVED

+91 8104948741

motivationalmonetaryfundas@gmail.com

Monday - Sunday: 8:00 AM - 8:00 PM